Getting new customers is great, especially when it comes to increasing your bottom line as a business, but do you know what is even better? CUSTOMER RETENTION!

Imagine having 500 customers at the start of the year, and then 270 of them suddenly churn. To perform better than you did at the start of the year, you will need at least 271 new clients. Getting these 271 customers won't even be easy because the 270 might have left negative reviews that will dissuade potential new customers.

You already spent a lot of time trying to get the customers you currently have, so why not keep them satisfied rather than bringing in customers after customers that will eventually churn? You might even reach a point where you don’t get any new customers. Don’t underestimate the power of word of mouth, especially negative ones.

Now, we are not saying you should not focus on customer acquisition. Instead, we are saying also focus on customer retention because a good balance of the two gives you that healthy bottom line and profitability that you require.

You don’t want to be the executive that sacrifices one for the other, it might have disastrous consequences in the end

What exactly is customer retention?

In simple terms, it is a measure of how many people use your business and stay loyal over a period of time.

To achieve good customer retention, you want to ensure that a customer makes repeat purchases or pays the subscription fee anytime it is due, is satisfied with your company’s services, and does not start patronizing a competitor.

How do you know you are ticking all these boxes? You have to keep a close eye on something called customer retention rate. If your customer retention rate is high, the chances of churn are low. If your customer retention rate is low, the chances of churn are high.

Why should you keep an eye on your customer retention rate?

Ultimately, your goal as a business is to make more money or at least stay above water. Paying close attention to your retention rate helps with that.

First off, acquiring a new customer can be up to 25 times more expensive than keeping an old one. So if you keep them satisfied, which you can measure with your customer retention rate, it saves you money on trying to replace them. Satisfied customers are also more likely to buy from you repeatedly and spread the word about your product or service, which brings in more customers. All these in the end make you more money.

How can you measure customer retention rate?

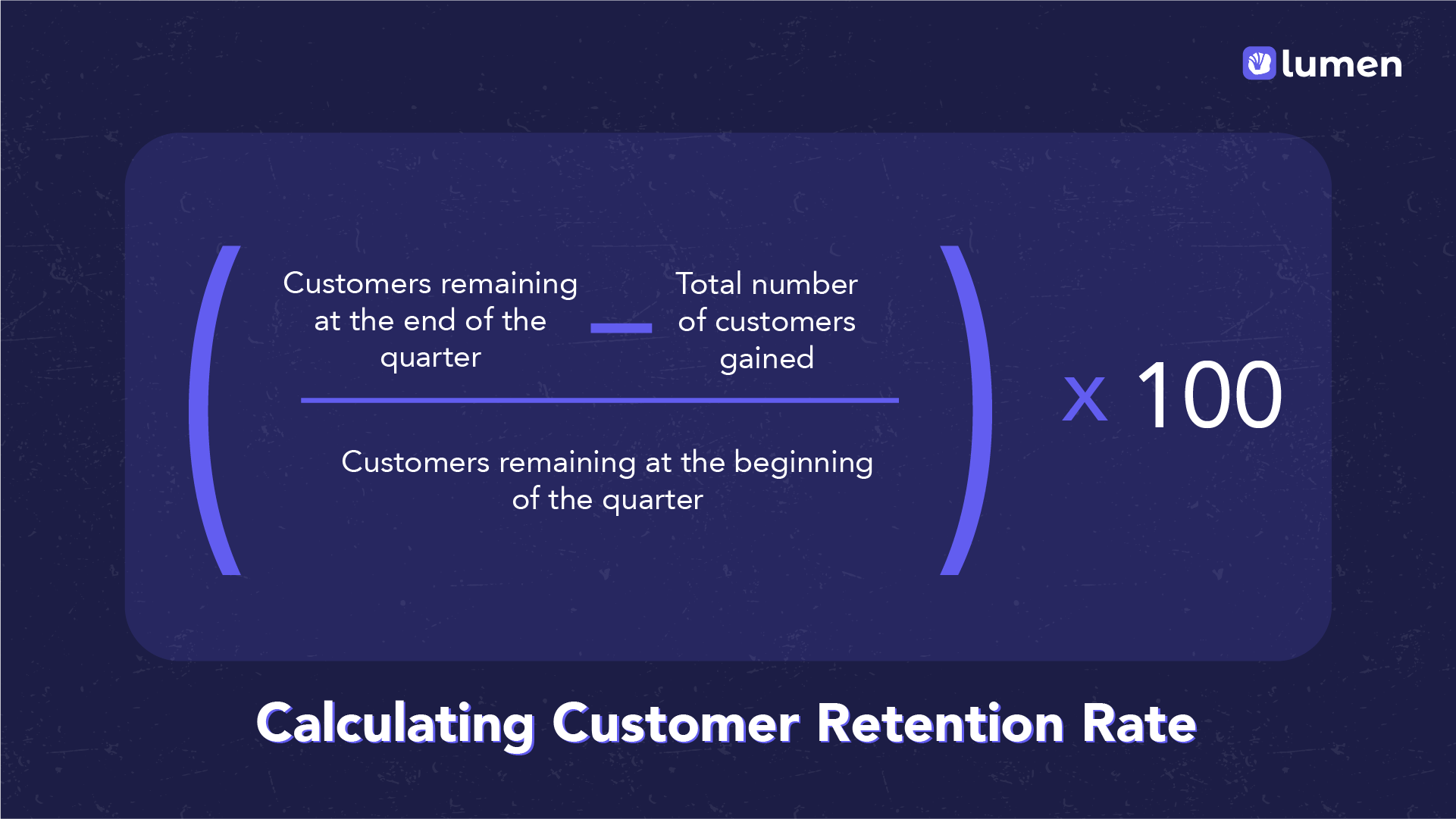

To calculate the customer retention rate, you are going to need the following

- A time frame because you need to check the total number of users in that specified time frame. It can be a year, it can be a month, it can be a quarter.

- The total number of customers you gained in that time frame.

- The remaining customers at the end of the time frame.

- The number of customers you had at the beginning of the time frame.

Then you subtract the total number of customers you gained in that time frame from the remaining customers at the end of the time frame.

Once you have this number, you divide it by the number of customers at the beginning of the time frame, then multiply by 100.

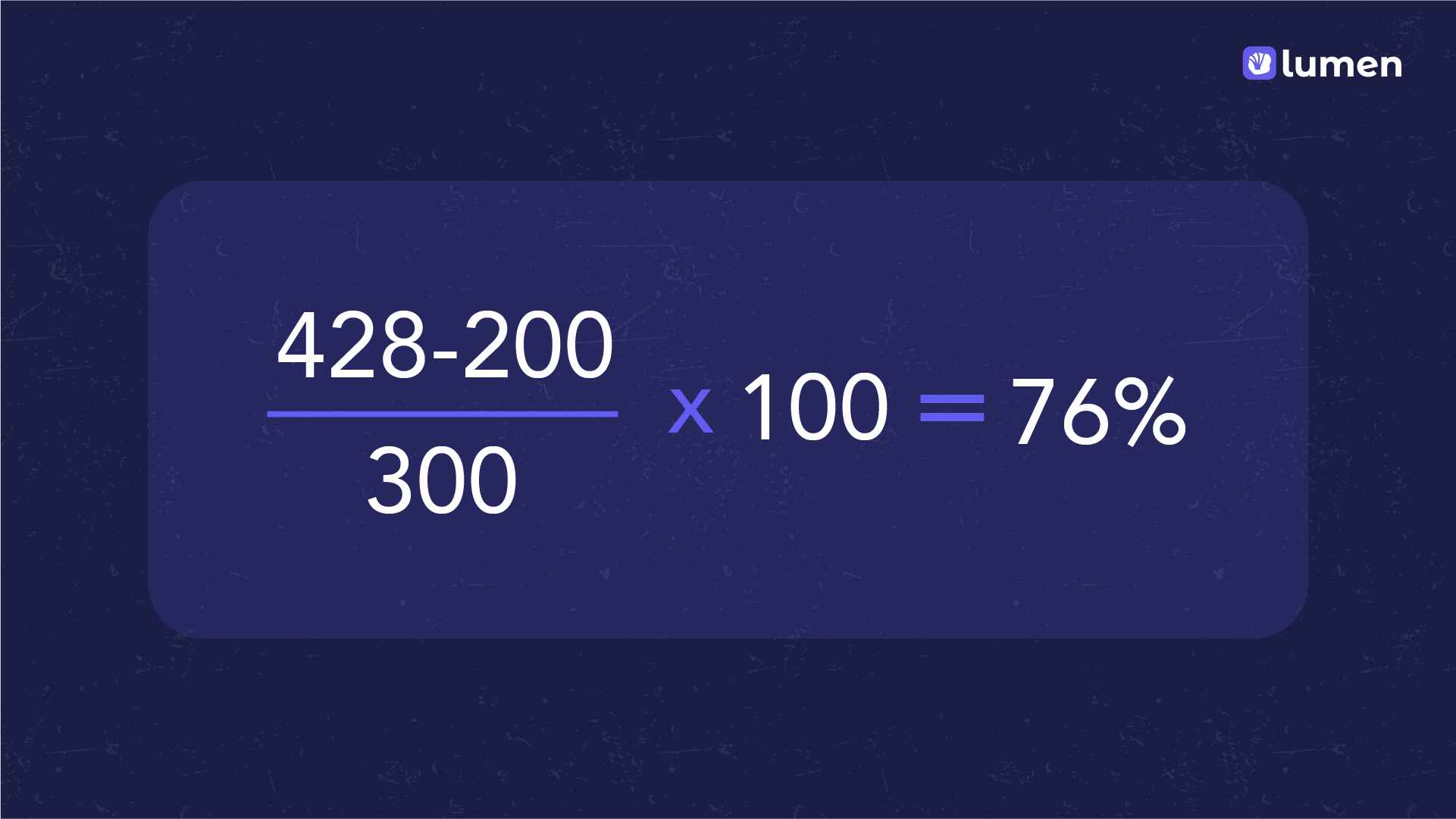

For example, time frame = one quarter (3 months)

Customers at the beginning of the quarter = 300

Total number of customers gained = 200

Customers remaining at the end of the quarter = 428

So customer retention rate = (428 -200/300) *100 = 76%

With this calculation, what’s a good retention rate and what’s not?

The answer to this is not straightforward and mostly lies in the benchmark you give yourself and depending on your product and industry, you’ll have different benchmarks for a successful retention rate.

Mostly, you can measure retention rate against two benchmarks:

- Your past performance

- Your competitors’ performance

Measuring it against these benchmarks tells whether you are doing better than before or better than your competitors. But measuring against your competitors, means you need to know what the industry benchmark is.

This might be a hard number to get and while it’s tempting to benchmark your customer retention rate against your industry’s, we will advise that you place most of your focus on improving your baseline customer retention rate number.

What are some common mistakes to avoid when measuring customer retention rate?

Looping the customers under different plans into one customer retention rate.

If your product or service operates on different payment plans, you need to calculate the retention rates separately.

Why?

Because people on higher payment plans are more useful to your bottom line, and you need to know when to pay special attention to them.

Calculating a retention rate with all your customers together is a rookie move because what if a large percentage of customers on a lower plan are happy while higher-paying customers are not? But you can’t tell because they are all calculated together.

Counting customers who have cancelled their subscription as churned customers

When a customer cancels, it means the next payment due will not be coming in, but you still have them for a little while as their subscription has not expired. Now is the time to use all the tricks in the book to change their mind. Ask them what you can do to change their mind, include a personal touch, and offer them something that sweetens the deal. The bottom line, do something! If you count customers that cancel as churned customers, immediately they cancel without making any effort to change their minds, you’re wreaking havoc on your future customer retention rate.

Not understanding that the retention rates for each stage of the customer lifecycle are different and making no allowance for that.

You need to know the average retention rate for each stage of your customer’s life cycle. The average retention rate of customers just signing up is probably way lower than that of loyal customers. You need to know what the retention rates are for each of these stages and know what new efforts to employ to raise the number before your next calculation. You also need to deeply understand their behaviours at these different stages before employing any tactic, so you don’t put them off.

Conclusion

Understanding your customers’ behaviours goes a long in improving customer retention, and the data and insights from Lumen help with that.

By looking closely at your consumer data, you can predict the kind of customer who is likely to stick with you, and you can also watch out for red flags that tell you that the customer is about to churn.

By intervening before that happens, you can hang on to those customers, thereby improving your retention rate. With Lumen’s analytics, you can go even deeper into their user journey and engagement.

So try Lumen today and visit https://uselumen.co/ to get started.